Blog Archives

Crowdsolving and MH370

Posted by Iker Ibanez

Tomnod – enabling the crowd search for the missing Malaysia Airlines Flight 370 – Picture courtesy of Tomnod

It’s been 9 painful days since Malaysia Airlines flight 370 vanished from secondary radar on the early morning of Saturday the 8th of March en-route from Kuala Lumpur to Beijing. As sad as the story and mystery of the whereabouts is, a beautiful use of Technology, Digital and Social Media has come on the spotlight in the hunt of the plane. The idea is simply brilliant. Thousands of detailed, freshly captured satellite images are made available to the public, allowing the crowd to collaborate in the humongous task of combing thousands of square miles of ocean in the search for any trace of the missing plane. The imagery is provided by DigitalGlobe, who owns and operates the network of satellites that constantly capture the images, with Tomnod being their crowdsourcing arm.

The mechanics are simple, and brilliant. Just browse to Tomnod’s website and join the cause. Tomnod will assign you tiles of the map where the search area is being focused, allowing you to tag different types of objects as you find them. With a simple and incredibly intuitive user interface, you can be collaborating to the cause in a matter of seconds

Whilst in this particular case the plane is yet to be found, this has been successful in the past in finding a missing light plane in Idaho, helping response and humanitarian aid teams prioritize they activities in the aftermath of devastating super typhoon Haiyan or mapping the damage of a deadly tornado in Oklahoma.

Tomnod has helped resolve real problems in recent times – picture courtesy of Tomnod.

It just comes to demonstrate how Technology can help solve real world complex problems, by organizing and coordinating a massive collaboration effort across the globe. Beautiful idea, hope it is as successful this time as it was in the past. You can help, spread the word!.

Posted in Uncategorized

Tags: Aircraft, Airlines, Applications, Crowdsourcing, Digital, Malaysia Airlines, MH370, Social Media

Fitness, Gamification and Payments – or what the iPhone 6 should bring to the party

Posted by Iker Ibanez

So this could be it, the next generation of the iPhone seems to squeeze into a thinner case to possibly maintain it’s volume while finally going beyond a 4 inch screen.

Form factor aside, there are two elements that I believe would be the next trend setters: Fitness and Payments.

Payments

For the last two generations we have been missing NFC to be packed into the iPhone, sending a clear signal that this is not what Apple believed in for the short range / contactless communications required for mobile payments. In exchange, the iBeacon technology was introduced in iOS7, built over bluetooth 4.0, by making use of the BLE (Bluetooth Low Energy) standard.

In short, iBeacons are indoor located, low-power, low-cost emitting devices that, making use of the BLE, can make iOS devices in their vicinity aware of their presence. This enables all sort of use cases based on close proximity, allowing for any system to send notifications to your iPhone. The main advantage over NFC is that is doesn’t require any specific hardware on the mobile device, as it operates over Bluetooth 4.0, and it broadens the possibilities well beyond sending payments from a POS to a mobile device for them to be authorised (remember that fingerprint reader in the iPhone 5S?), retailers are already using iBeacons to enhance and augment shopping experiences.

Bits and pieces of the eventual payments ecosystem have been gradually introduced, with Passbook, introduced in iOS6 possibly playing a role in storing your payments information in conjunction with iCloud keychain. iBeacons would solve the problem of communicating with the mobile device to exchange the payment information and get the operation authorised.

It’s yet to be seen how far will Apple want to go, as this model would just automate and mobilise payments and allow for Customers to digitise their credit cards, but essentially the payment method would still be a credit card, which limits the revenue Apple would get should they become a payment processor. With about a billion credit cards on file, it’s difficult to believe they wouldn’t want to make the jump, but that’s possibly material for another post on the matter.

Fitness

It’s not a secret that games are the most highly ranked and rated mobile apps in all platforms, together with the most retained. Such is the difference with other applications that a whole science has been crafted to bring what makes games so addictive to other applications and businesses: Gamification.

Gamification is the use of game thinking and game-mechanics in a non-game context to engage users and solve problems.

Wikipedia

Gamification techniques are based on human’s natural desire for competition, achievement, status and altruism, and can be implemented into applications in different manners:

- Rewarding the customer for accomplishing desired tasks (badges, levels, virtual currency or just showing a progress bar)

- Encouraging competition by making achievements and rewards visible to other players or providing leader boards

- Integration with Social Media increases visibility and leverages the power of referral and recommendation, together with the engagement and competition with friends and relatives for progress

Quite a few companies have understood these dynamics and are getting increased engagement in all sort of fields, and fitness couldn’t be a better example. SmartPhones have been good companions in fitness in the last few years, and recent developments like Fitbit or Nike with Nike+ are putting all the Gamification ingredients in the shaker to create a perfect SmartPhone-Fitness-Social Media triangle. These companies are having to develop hardware to cover for the natural lack of fitness specific sensors in SmartPhones, but that is possibly going to change, and here is where I believe the iPhone 6 will again step ahead of the competition.

Reportedly, Apple would be packing into the 6 a few sensors that would enhance it’s fitness capabilities, like the ability to measure heart rate. The motion coprocessor is already there and tracks your movements with precision, so with new additions the 6 could be the perfect fitness companion. Game!

Posted in Uncategorized

Tags: Apple, Device, Fitness, iBeacon, Innovation, iPhone, NFC, Payments, Phone, Sensors, Social Media

It’s already happening

Posted by Iker Ibanez

Only a few days after this post where Social Media adoption by the Banking industry is analyzed, it is already happened. A Bank has taken the step forward to truly start providing banking services to their customers on Facebook.

Digital Life

Whether we like it or not, our customers’ digital life happens in the Social Media. They live and interact there, not in our online banking platform. Therefore it was only a matter of time that someone overcame the resistance and found a way of blurring the boundaries and integrating with their customers’ digital life.

As anticipated, security was -and still is- the main concern both for Financial Institutions as well as Customers when approaching Banking services on the Social Media. Other industries and online services are clearly adopting Social Media profiles as a universal form of authentication, in which your Facebook ID or your Google+ profile become your Digital identity. If Facebook and Google+ are a representation of your real life as an individual, your identities in such platforms should be sufficient proof of identity of your Digital existence.

ICICI’s approach is to make the customer go through a registration process which creates a personalized password. Usage of the application also implies a second factor of authentication, so the customer experience will look quite similar to that of the existing online banking, but at least within your Facebook environment. It will be interesting to see how new approaches to securing Banking services on Social Media will help blur the boundary even more, to a point where there will be virtually no separation between your friends’ posts and your account statements, maybe just a step-up with a strong two factor authentication to protect sensitive data, but avoiding registration processes that somehow impact the illusion of full integration. This would have an interesting consequence: If many sites allow you to log on using your Facebook ID, why should your bank be different?. Why not simplify the process and just use your Facebook ID with a second factor of authentication?.

Anyhow, a very interesting and innovative movement by ICICI which will surely be followed by competitors very soon, and will help gauge the appetite of customers for Banking Services integrated in their very own Digital space.

Posted in Application, Banks, Channels, Facebook, Google, Google+, Social Media, Social network

Tags: Applications, Authentication, Bank, Banking Services, Facebook, Google, Online Banking, Social Media, Social network

Born Social

Posted by Iker Ibanez

Just like new generations are growing with an iPhone in their hands, and therefore have a much more natural adoption of technology in their lives, some newly established companies are having a completely natural approach to using Social Media. This is the case of Scoot, a recently launched low cost airline by Singapore Airlines, who is making extensive use of Social Media to engage their future customers. Barely three weeks after their formal launch, and months before they actually start operating, they already have a blog as well as a facebook page with over 5400 fans. The number itself might not be too high, but it is surely an achievement for a firm just a few weeks old that has yet to start operating.

While more established, traditional firms struggle to adopt and embed Social Media in their relationship with customers, it is an intrinsic part of the culture of these newly born businesses which take huge advantage of it. I was very pleased to see that Scoot is fully adopting these channels as THE natural way of engaging their future customers, not only by promoting their future business, but also by giving an insight into the thrilling process of building an airline from scratch. Last post on Facebook is presenting the CFO of the company to the public, similarly to what they did with their Chief Pilot. This is truly creating a whole new dimension in the relationship with customers, letting them know the human side of your business.

Good luck Scoot!

An image is worth a thousand words – Bank of the future – part 2

Posted by Iker Ibanez

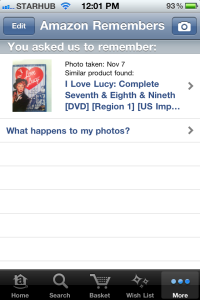

A few weeks back I was introduced to Google Goggles. The technology is amazing, yes, but at that point in time there was little commercial application for it, other than triggering searches with an image instead of a few words. The idea is pretty

good and powerful, and promises to be even more when more recognition capabilities are added to the solution. As of today, it can recognize text, logos, landmarks, books, wine, artwork and contact information.

The idea behind this technology is really powerful, and clearly a must have for the compulsive I want what I see buyer. See something fancy on the street? Just take a pic not only to learn what it actually is but eventually to the best places to buy it online, right from your SmartPhone.

Very promising, but still a bit far away from having the level of recognition for such an application to takeoff.

Whilst general purpose recognition might be a challenge, Amazon has taken this technology to the next stage by creating the first commercial application of it. Narrowing

the scope of objects to be recognizes shows surprising effects. Read Amazon remembers here. Still in beta, but yet amazing. See a book, DVD or videogame?. Just take a picture of it, and it is very likely to be recognized. You are instantly presented with the offers of your selected Amazon store. It simply works.

Potential

Businesses like Amazon, selling material goods over the internet, are likely to take benefit of this technology, and it is only a matter of time that the technology will mature and image will be as used as text as an input for searches. Actually, it is quite natural to search for something you know how it looks like but of which you do not necessarily know its name.

The challenge comes in industries where the goods are not material, or are not directly linkable to something material of which you can take a picture. Air Travel and Banks fall within this category, yet I think can get great benefit of such technology.

Air travel can easily be linked with a picture of a location or landmark that is clearly recognizable. Following Google’s own example with San Francisco’s Golden Gate, just take a picture of it and you can be presented with the best offers to travel there from your selected home location. Maybe even better if you actually don’t know the name of the place but see a wonderful poster, just take a picture and find out how much it will take you to fly there for the next holiday. Nice.

Financial Services is a bit more difficult, as the products are not easily linkable to something material, but there are still potential applications for this in the industry. Promotion locators are growing in popularity with the location based capabilities of SmartPhones. These can get great benefit of image recognition, so promotions are now filtered to the specific product you want to buy, which you just saw. This truly takes the buying experience to the next level, as not only you can identify the product you wish to buy and where it is sold, but also in which specific merchants in your surroundings you can get the best promotion from your bank.

The Bank of the future will have to expand its own boundaries, to have more presence in the life of its customers, and technologies like this will certainly play a role on this.

While traditional banking services can still benefit of image recognition (will you take a picture of a checkbook and request it through such a mobile app, instead of doing it through online banking?), the biggest jump comes when the Bank becomes an enabler of your day to day life. Being involved and everything, from every

day purchases to your once in a lifetime acquisitions.

Are you buying something you just took a picture of?. We are here to offer you the b

est promotion for it when using our cards. Are you searching for the ultimate vacation by sending a picture of that beach?. Here we are to offer you the best financing and insurance package. The financial service is not the final product, but the enabler. And I am sure a wise and wide application of these technologies can create a next level of engagement with customers in the Banking industry.

Bank of the future – part 1

Posted by Iker Ibanez

Ever since call centres and ATM’s where adopted as the first form of Alternative Channels banks have been looking for ways of offloading their branches and moving low value, high volume transactions to lower unitary cost channels.

Ever since call centres and ATM’s where adopted as the first form of Alternative Channels banks have been looking for ways of offloading their branches and moving low value, high volume transactions to lower unitary cost channels.

The Internet promised to bring this offloading strategy to the next level, by providing a channel with unitary costs on levels a fraction of those in the traditional ones. Despite few honorable exceptions of institutions that have really given the Internet channel a life of its own, most banks have relied on alternative channels as a means of bringing down the operational costs, leaving the human interaction for the high-value commercial transactions and financial advisory functions.

This might have come to an end, thanks to two main factors that are driving a substantial change in the way banks interact with their customers: Mobile and Social Media.

Mobile: A life of its own

The exponential growth of mobile applications have finally created a channel with a life of its own, where customers are approached and serviced in a new way. Where services exclusive to this channel are offered, and where banks are fiercely competing to differentiate themselves. Mobile applications and the power of Smart Phones are allowing banks to expand their relationship with customers, no longer constrained to the provisioning of financial services, but providing an emotional link between them and the customers lifestyle.

It is not just about allowing you to make a payment easily, or to buy or sell shares on the move. It is about providing an offering that is meaningful for you, in the place you are, in the mood you are or in the stage of your life you are in. More and more advanced services are proliferating around mobile applications which deviate from the traditional approach of using alternative channels as a cost cutter.

Wisely used, mobile applications can help the bank be seen an enabler in the customers lifestyle, which is just what it should be.

Social Media: The focus shifted

Social Media has probably not created the concept of digital life, but definitely has helped bring it to a level where virtually anyone has a very complete digital life, which is no more than a reflection of one’s real counterpart. Sharing your real life in your digital one has become a habit for hundreds of millions. The activity in these media is such that companies can simply not afford to be there, where their customers life happens. Where customers express their views and opinions about companies and their experiences with them, and where the early adopters are already starting to do some good business.

The focus is radically shifted towards the customer, which now has truly become king, now yes, this being completely true. Now customers decide what, where and when. Customers decide how and where they give you feedback, and how and where they want to interact with you.

Yet another channel with a life of its own.

As suggested by the title of this post, more to come on very interesting forms of channels like QR Codes and Microsoft Tags, and possibilities opened by new technologies like Siri.

This is not an app review

Posted by Iker Ibanez

This is not an app review. It is rather some thoughts and reflections on how much technology and features are packed in any of the SmartPhones you can buy today. We have taken it for granted, but it is truly amazing to see that you can carry in your pocket a device that contains a GPS, a compass, a high definition photo and video camera, plays music, browses the internet and is capable of doing all at the same time through powerful multitasking. But does anyone need so many features?. I thought not.

But then I started running. I am not a big fan of it, so I just started to reduce a bit of extra weight gained during the holidays. However, I found an application that motivated me to start, and to continue doing it on a regular basis. It is called Runmeter. Probably there are a lot of applications similar to this one, but this is the one I chose, and with which I truly realized how wonderful applications and features you can build when you make use of all the powerful technology Smart Phones pack today.

GPS

You define a route, press the start button and there you go. It tracks your run by GPS pretty accurately. Not only it tracks where you go, but also how fast you go, so you get instant pace, average pace, pace per km, even altitude deviations, although these are not really accurate. The GPS bit in action. Good?. Wait and see…

Internet

Do you need Internet connection while running?. Not for web browsing, definitely, but one fantastic feature of this application is that it integrates with facebook and other social networks, so you can choose what the app publishes for you when you start, stop and finish running. Social Media is all about sharing and interacting, so now you can share your progress while you train. Nothing revolutionary here, but this becomes really fancy when you go to the next step, and you not only share but you also interact. How can you interact while you are running?. Easy, the application will monitor any comments your friends might do on your “Started run” post on facebook and guess what? It will read them out loud to you on your headset. This is my favorite feature, it is really motivating, and when your friends know that they are being read out loud while you run, they really become imaginative and encouraging. Really good.

And music!

What is running without music?. All of the above while you keep your pace listening to your music. Either with the standard iPod included in your iPhone or with my favorite Spotify, that allows you to find those disco hits from the early 90’s you used to dance to and remember the time while on the run. Superb.

Probably none of these are truly revolutionary aspects from a technology perspective, not even from the fact of being packed into a tiny little device. It is the combination of all of them working in harmony that makes really good applications possible.

Sensorconomy

We started by integrating data into applications, now we are integrating sensors like GPS or compass. Some analysts predict Sensorconomy would be the next big thing in Smart Phones by introducing temperature, humidity,light and other sensors into Smart Phones to extend the boundaries of your device and allow it to interact more. I really think the hardware is going further ahead than the applications in the mobile space, which is really thrilling. We have just started to take off in making use of the current possibilities so the future of mobile applications looks promising, at the very least.

Posted in Application, Devices, Innovation, iOS, Sensorconomy, Smartphones, Social Media, Sophistication, Technology

Tags: Applications, Device, Facebook, GPS, Innovation, Integration, Runmeter, Sensor, Sensorconomy, SmartPhone, Social Media, Social network, Spotify

Social Media and Customer Relations

Posted by Iker Ibanez

This wonderful article made me think about how some industries are making use of Social Media whilst other are still very hesitant about it. It also does a very interesting insight on how the relationship between these companies and their customers are changing, and even more interesting, how the perception the customers get are also changing accordingly.

Air travel is being one of the industries which most benefit is getting from Social Media. Nearly 200 airlines are already actively present in Social Media, and the nature of this industry is clearly benefiting from having a direct and real time communication channel with their customers. Air travel operations are subject to innumerable and unpredictable situations that cause disruptions and delays. So from a purely operational point of view, it is clear that Social Media, specially facebook and twitter are key elements in this new way of addressing customer communications. Delays and cancellations for any of the classical reasons -weather, plane maintenance, crew rotation, etc.- can now be made known to the wide audience.

Not that this will solve any of the issues and eliminate the delays or cancellations, but it is definitely helping customers be aware of the situation and plan accordingly. Knowing is better than not definitely.

This is probably the most obvious usage of Social Media, but probably not the most powerful. Three different usages can be identified:

- Communication with customers (operational)

- Feedback

- Marketing and sales

The power of feedback

Think about feedback. This is a double edged weapon. Feedback is good, and making things easier for customers to give feedback right where and when the issue or the good experience is happening clearly encourages more than filling a feedback form. People just tweet their last good or bad experience, or post a comment on your wall about it. This is really powerful, but demands a managed presence in Social Media to be able to listen to this feedback effectively.

But this has a downside too, which I tend to see as a big opportunity. You can no longer hide failure. If you cause a problem to a customer, not only you will know, your whole set of followers will do. This obviously can be seen as a downside, but I clearly see this as an opportunity for companies to improve customer service and attention, and really treat customers as they deserve. Furthermore, most of the failures in customer service will remain undetected behind the fact that customers rarely complained, and even more, complains never reached the media. Now this has completely changed, but also for good, now you know where your weakest points are, so your customers become your best allies.

The true revolution

The more I look at Social Media adoption in the large Enterprise, the more I see it as a movement towards customer centricity. No longer we make the customer come to our online systems, we go to where the customer spends his or her time

online. We do not ask for feedback or claims to be given in a particular manner and a particular place, we listen to the customer wherever and whenever the customer is.

This is for me the authentic revolution of Social Media in the Enterprise. Not only being able to communicate, but reinventing all our customer interactions to be where and when the customer is, on every occasion where the customer needs to interact with us. For good and for bad.

For me, this is why Social Media is already revolutionary. Now I am really keen to see how other industries adopt are able to open themselves to this new world of possibilities. Challenging but really thrilling and full of potential.