Category Archives: Banks

It’s already happening

Posted by Iker Ibanez

Only a few days after this post where Social Media adoption by the Banking industry is analyzed, it is already happened. A Bank has taken the step forward to truly start providing banking services to their customers on Facebook.

Digital Life

Whether we like it or not, our customers’ digital life happens in the Social Media. They live and interact there, not in our online banking platform. Therefore it was only a matter of time that someone overcame the resistance and found a way of blurring the boundaries and integrating with their customers’ digital life.

As anticipated, security was -and still is- the main concern both for Financial Institutions as well as Customers when approaching Banking services on the Social Media. Other industries and online services are clearly adopting Social Media profiles as a universal form of authentication, in which your Facebook ID or your Google+ profile become your Digital identity. If Facebook and Google+ are a representation of your real life as an individual, your identities in such platforms should be sufficient proof of identity of your Digital existence.

ICICI’s approach is to make the customer go through a registration process which creates a personalized password. Usage of the application also implies a second factor of authentication, so the customer experience will look quite similar to that of the existing online banking, but at least within your Facebook environment. It will be interesting to see how new approaches to securing Banking services on Social Media will help blur the boundary even more, to a point where there will be virtually no separation between your friends’ posts and your account statements, maybe just a step-up with a strong two factor authentication to protect sensitive data, but avoiding registration processes that somehow impact the illusion of full integration. This would have an interesting consequence: If many sites allow you to log on using your Facebook ID, why should your bank be different?. Why not simplify the process and just use your Facebook ID with a second factor of authentication?.

Anyhow, a very interesting and innovative movement by ICICI which will surely be followed by competitors very soon, and will help gauge the appetite of customers for Banking Services integrated in their very own Digital space.

Posted in Application, Banks, Channels, Facebook, Google, Google+, Social Media, Social network

Tags: Applications, Authentication, Bank, Banking Services, Facebook, Google, Online Banking, Social Media, Social network

Born Social vs Learnt Social

Posted by Iker Ibanez

Following the previous post on Scoot, and how they are a truly born social company, it is interesting to compare how their evolution is in Social Media as compared to more established companies that are learning how to become social and adopting it on their way.

It is becoming more and more clear that Social Media is not only going to be the way to gain a more close and personal relationship with your customers, but also a full service channel that will probably start moving business out of your current electronic platforms. Some industries will be earlier adopters than others, and some examples of this can be found on the airline industry, where Malaysia Airlines is already offering flight search, booking and check-in can be done in a facebook app.

Security and privacy concerns will slow down the adoption for certain industries, namely the Financial Services, but yet there is already space for certain features to be offered in Social Media. Citibank recently launched a new facebook app that allows their customers group their reward points they obtain for purchases and use them for charity or a group gift. Rewards seems to be quite the right transaction for Banks to start servicing customers over Social Media, as its level of risk is far lower than traditional financial transactions.

It will be interesting to see and compare the adoption curve for established companies, specially on highly risk aware industries like Banking as compared to companies born social like Scoot, who have adopted Social Media in a very natural manner for literally every single internal process they are facing in the journey of setting up the airline: Recruiting, selecting their slogan and offering promotions. It will not be surprising to see that Facebook -their Google+ page is yet to be seen- will become their main sales and servicing channel when they start operating.

Will this be the trend followed by other industries and therefore, will Social Media replace -at least partially- online banking? I make my bet!

An image is worth a thousand words – Bank of the future – part 2

Posted by Iker Ibanez

A few weeks back I was introduced to Google Goggles. The technology is amazing, yes, but at that point in time there was little commercial application for it, other than triggering searches with an image instead of a few words. The idea is pretty

good and powerful, and promises to be even more when more recognition capabilities are added to the solution. As of today, it can recognize text, logos, landmarks, books, wine, artwork and contact information.

The idea behind this technology is really powerful, and clearly a must have for the compulsive I want what I see buyer. See something fancy on the street? Just take a pic not only to learn what it actually is but eventually to the best places to buy it online, right from your SmartPhone.

Very promising, but still a bit far away from having the level of recognition for such an application to takeoff.

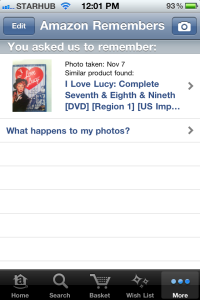

Whilst general purpose recognition might be a challenge, Amazon has taken this technology to the next stage by creating the first commercial application of it. Narrowing

the scope of objects to be recognizes shows surprising effects. Read Amazon remembers here. Still in beta, but yet amazing. See a book, DVD or videogame?. Just take a picture of it, and it is very likely to be recognized. You are instantly presented with the offers of your selected Amazon store. It simply works.

Potential

Businesses like Amazon, selling material goods over the internet, are likely to take benefit of this technology, and it is only a matter of time that the technology will mature and image will be as used as text as an input for searches. Actually, it is quite natural to search for something you know how it looks like but of which you do not necessarily know its name.

The challenge comes in industries where the goods are not material, or are not directly linkable to something material of which you can take a picture. Air Travel and Banks fall within this category, yet I think can get great benefit of such technology.

Air travel can easily be linked with a picture of a location or landmark that is clearly recognizable. Following Google’s own example with San Francisco’s Golden Gate, just take a picture of it and you can be presented with the best offers to travel there from your selected home location. Maybe even better if you actually don’t know the name of the place but see a wonderful poster, just take a picture and find out how much it will take you to fly there for the next holiday. Nice.

Financial Services is a bit more difficult, as the products are not easily linkable to something material, but there are still potential applications for this in the industry. Promotion locators are growing in popularity with the location based capabilities of SmartPhones. These can get great benefit of image recognition, so promotions are now filtered to the specific product you want to buy, which you just saw. This truly takes the buying experience to the next level, as not only you can identify the product you wish to buy and where it is sold, but also in which specific merchants in your surroundings you can get the best promotion from your bank.

The Bank of the future will have to expand its own boundaries, to have more presence in the life of its customers, and technologies like this will certainly play a role on this.

While traditional banking services can still benefit of image recognition (will you take a picture of a checkbook and request it through such a mobile app, instead of doing it through online banking?), the biggest jump comes when the Bank becomes an enabler of your day to day life. Being involved and everything, from every

day purchases to your once in a lifetime acquisitions.

Are you buying something you just took a picture of?. We are here to offer you the b

est promotion for it when using our cards. Are you searching for the ultimate vacation by sending a picture of that beach?. Here we are to offer you the best financing and insurance package. The financial service is not the final product, but the enabler. And I am sure a wise and wide application of these technologies can create a next level of engagement with customers in the Banking industry.

Bank of the future – part 1

Posted by Iker Ibanez

Ever since call centres and ATM’s where adopted as the first form of Alternative Channels banks have been looking for ways of offloading their branches and moving low value, high volume transactions to lower unitary cost channels.

Ever since call centres and ATM’s where adopted as the first form of Alternative Channels banks have been looking for ways of offloading their branches and moving low value, high volume transactions to lower unitary cost channels.

The Internet promised to bring this offloading strategy to the next level, by providing a channel with unitary costs on levels a fraction of those in the traditional ones. Despite few honorable exceptions of institutions that have really given the Internet channel a life of its own, most banks have relied on alternative channels as a means of bringing down the operational costs, leaving the human interaction for the high-value commercial transactions and financial advisory functions.

This might have come to an end, thanks to two main factors that are driving a substantial change in the way banks interact with their customers: Mobile and Social Media.

Mobile: A life of its own

The exponential growth of mobile applications have finally created a channel with a life of its own, where customers are approached and serviced in a new way. Where services exclusive to this channel are offered, and where banks are fiercely competing to differentiate themselves. Mobile applications and the power of Smart Phones are allowing banks to expand their relationship with customers, no longer constrained to the provisioning of financial services, but providing an emotional link between them and the customers lifestyle.

It is not just about allowing you to make a payment easily, or to buy or sell shares on the move. It is about providing an offering that is meaningful for you, in the place you are, in the mood you are or in the stage of your life you are in. More and more advanced services are proliferating around mobile applications which deviate from the traditional approach of using alternative channels as a cost cutter.

Wisely used, mobile applications can help the bank be seen an enabler in the customers lifestyle, which is just what it should be.

Social Media: The focus shifted

Social Media has probably not created the concept of digital life, but definitely has helped bring it to a level where virtually anyone has a very complete digital life, which is no more than a reflection of one’s real counterpart. Sharing your real life in your digital one has become a habit for hundreds of millions. The activity in these media is such that companies can simply not afford to be there, where their customers life happens. Where customers express their views and opinions about companies and their experiences with them, and where the early adopters are already starting to do some good business.

The focus is radically shifted towards the customer, which now has truly become king, now yes, this being completely true. Now customers decide what, where and when. Customers decide how and where they give you feedback, and how and where they want to interact with you.

Yet another channel with a life of its own.

As suggested by the title of this post, more to come on very interesting forms of channels like QR Codes and Microsoft Tags, and possibilities opened by new technologies like Siri.