Category Archives: Social Media

Cars: The next app frontier

Posted by Iker Ibanez

It’s no secret that apps have changed the way we consume content and software, and expressions like “I have an app for that” are now part of our daily lexicon. Little by little, the appmania has been overflowing SmartPhones and Tablets. TVs where the next conquered territory, and now it seems that cars, and more specifically, on board infotainment systems are the next frontier.

Key players in the industry like Denso, QNX, Magneti Marelli and the traditional car manufacturers are already working in their respective strategies for bringing apps to your car. While most of the current trends are around driving performance and self-diagnostics, extending the features currently available on most infotainment systems, some brands are already introducing very popular general purpose apps. Read Lexus here, and the recently launched latest version of their on board system, Enform, which includes some interesting apps available on board the car. Things like buying movie tickets or booking a table at your destination are now possible, even through the cars voice commands. Even checking in your destination on Facebook is now something you can do behind the steering wheel.

This probably opens a new question behind the technology on which these on board infotainment systems are based. Will we see Android or iOS based in car navigation systems?. It would definitely be very exciting as this would mean instant availability of thousands, if not millions, of apps right to be installed in your car. Interesting potential advantage for Android as some of the current platforms are already based on Linux, which could mean easier integration of Android-based apps onboard.

Posted in Android, Apple, Apps, Cars, Facebook, Google, iOS, Smartphones, Tablets, Technology, Uncategorized

Tags: Apple, Applications, Car, Facebook, Google, Infotainment, SmartPhone, Tablet, Technology

It’s already happening

Posted by Iker Ibanez

Only a few days after this post where Social Media adoption by the Banking industry is analyzed, it is already happened. A Bank has taken the step forward to truly start providing banking services to their customers on Facebook.

Digital Life

Whether we like it or not, our customers’ digital life happens in the Social Media. They live and interact there, not in our online banking platform. Therefore it was only a matter of time that someone overcame the resistance and found a way of blurring the boundaries and integrating with their customers’ digital life.

As anticipated, security was -and still is- the main concern both for Financial Institutions as well as Customers when approaching Banking services on the Social Media. Other industries and online services are clearly adopting Social Media profiles as a universal form of authentication, in which your Facebook ID or your Google+ profile become your Digital identity. If Facebook and Google+ are a representation of your real life as an individual, your identities in such platforms should be sufficient proof of identity of your Digital existence.

ICICI’s approach is to make the customer go through a registration process which creates a personalized password. Usage of the application also implies a second factor of authentication, so the customer experience will look quite similar to that of the existing online banking, but at least within your Facebook environment. It will be interesting to see how new approaches to securing Banking services on Social Media will help blur the boundary even more, to a point where there will be virtually no separation between your friends’ posts and your account statements, maybe just a step-up with a strong two factor authentication to protect sensitive data, but avoiding registration processes that somehow impact the illusion of full integration. This would have an interesting consequence: If many sites allow you to log on using your Facebook ID, why should your bank be different?. Why not simplify the process and just use your Facebook ID with a second factor of authentication?.

Anyhow, a very interesting and innovative movement by ICICI which will surely be followed by competitors very soon, and will help gauge the appetite of customers for Banking Services integrated in their very own Digital space.

Posted in Application, Banks, Channels, Facebook, Google, Google+, Social Media, Social network

Tags: Applications, Authentication, Bank, Banking Services, Facebook, Google, Online Banking, Social Media, Social network

Born Social vs Learnt Social

Posted by Iker Ibanez

Following the previous post on Scoot, and how they are a truly born social company, it is interesting to compare how their evolution is in Social Media as compared to more established companies that are learning how to become social and adopting it on their way.

It is becoming more and more clear that Social Media is not only going to be the way to gain a more close and personal relationship with your customers, but also a full service channel that will probably start moving business out of your current electronic platforms. Some industries will be earlier adopters than others, and some examples of this can be found on the airline industry, where Malaysia Airlines is already offering flight search, booking and check-in can be done in a facebook app.

Security and privacy concerns will slow down the adoption for certain industries, namely the Financial Services, but yet there is already space for certain features to be offered in Social Media. Citibank recently launched a new facebook app that allows their customers group their reward points they obtain for purchases and use them for charity or a group gift. Rewards seems to be quite the right transaction for Banks to start servicing customers over Social Media, as its level of risk is far lower than traditional financial transactions.

It will be interesting to see and compare the adoption curve for established companies, specially on highly risk aware industries like Banking as compared to companies born social like Scoot, who have adopted Social Media in a very natural manner for literally every single internal process they are facing in the journey of setting up the airline: Recruiting, selecting their slogan and offering promotions. It will not be surprising to see that Facebook -their Google+ page is yet to be seen- will become their main sales and servicing channel when they start operating.

Will this be the trend followed by other industries and therefore, will Social Media replace -at least partially- online banking? I make my bet!

Born Social

Posted by Iker Ibanez

Just like new generations are growing with an iPhone in their hands, and therefore have a much more natural adoption of technology in their lives, some newly established companies are having a completely natural approach to using Social Media. This is the case of Scoot, a recently launched low cost airline by Singapore Airlines, who is making extensive use of Social Media to engage their future customers. Barely three weeks after their formal launch, and months before they actually start operating, they already have a blog as well as a facebook page with over 5400 fans. The number itself might not be too high, but it is surely an achievement for a firm just a few weeks old that has yet to start operating.

While more established, traditional firms struggle to adopt and embed Social Media in their relationship with customers, it is an intrinsic part of the culture of these newly born businesses which take huge advantage of it. I was very pleased to see that Scoot is fully adopting these channels as THE natural way of engaging their future customers, not only by promoting their future business, but also by giving an insight into the thrilling process of building an airline from scratch. Last post on Facebook is presenting the CFO of the company to the public, similarly to what they did with their Chief Pilot. This is truly creating a whole new dimension in the relationship with customers, letting them know the human side of your business.

Good luck Scoot!

An image is worth a thousand words – Bank of the future – part 2

Posted by Iker Ibanez

A few weeks back I was introduced to Google Goggles. The technology is amazing, yes, but at that point in time there was little commercial application for it, other than triggering searches with an image instead of a few words. The idea is pretty

good and powerful, and promises to be even more when more recognition capabilities are added to the solution. As of today, it can recognize text, logos, landmarks, books, wine, artwork and contact information.

The idea behind this technology is really powerful, and clearly a must have for the compulsive I want what I see buyer. See something fancy on the street? Just take a pic not only to learn what it actually is but eventually to the best places to buy it online, right from your SmartPhone.

Very promising, but still a bit far away from having the level of recognition for such an application to takeoff.

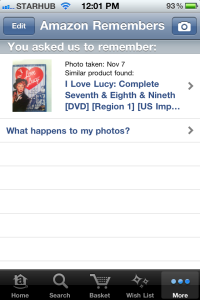

Whilst general purpose recognition might be a challenge, Amazon has taken this technology to the next stage by creating the first commercial application of it. Narrowing

the scope of objects to be recognizes shows surprising effects. Read Amazon remembers here. Still in beta, but yet amazing. See a book, DVD or videogame?. Just take a picture of it, and it is very likely to be recognized. You are instantly presented with the offers of your selected Amazon store. It simply works.

Potential

Businesses like Amazon, selling material goods over the internet, are likely to take benefit of this technology, and it is only a matter of time that the technology will mature and image will be as used as text as an input for searches. Actually, it is quite natural to search for something you know how it looks like but of which you do not necessarily know its name.

The challenge comes in industries where the goods are not material, or are not directly linkable to something material of which you can take a picture. Air Travel and Banks fall within this category, yet I think can get great benefit of such technology.

Air travel can easily be linked with a picture of a location or landmark that is clearly recognizable. Following Google’s own example with San Francisco’s Golden Gate, just take a picture of it and you can be presented with the best offers to travel there from your selected home location. Maybe even better if you actually don’t know the name of the place but see a wonderful poster, just take a picture and find out how much it will take you to fly there for the next holiday. Nice.

Financial Services is a bit more difficult, as the products are not easily linkable to something material, but there are still potential applications for this in the industry. Promotion locators are growing in popularity with the location based capabilities of SmartPhones. These can get great benefit of image recognition, so promotions are now filtered to the specific product you want to buy, which you just saw. This truly takes the buying experience to the next level, as not only you can identify the product you wish to buy and where it is sold, but also in which specific merchants in your surroundings you can get the best promotion from your bank.

The Bank of the future will have to expand its own boundaries, to have more presence in the life of its customers, and technologies like this will certainly play a role on this.

While traditional banking services can still benefit of image recognition (will you take a picture of a checkbook and request it through such a mobile app, instead of doing it through online banking?), the biggest jump comes when the Bank becomes an enabler of your day to day life. Being involved and everything, from every

day purchases to your once in a lifetime acquisitions.

Are you buying something you just took a picture of?. We are here to offer you the b

est promotion for it when using our cards. Are you searching for the ultimate vacation by sending a picture of that beach?. Here we are to offer you the best financing and insurance package. The financial service is not the final product, but the enabler. And I am sure a wise and wide application of these technologies can create a next level of engagement with customers in the Banking industry.

Bank of the future – part 1

Posted by Iker Ibanez

Ever since call centres and ATM’s where adopted as the first form of Alternative Channels banks have been looking for ways of offloading their branches and moving low value, high volume transactions to lower unitary cost channels.

Ever since call centres and ATM’s where adopted as the first form of Alternative Channels banks have been looking for ways of offloading their branches and moving low value, high volume transactions to lower unitary cost channels.

The Internet promised to bring this offloading strategy to the next level, by providing a channel with unitary costs on levels a fraction of those in the traditional ones. Despite few honorable exceptions of institutions that have really given the Internet channel a life of its own, most banks have relied on alternative channels as a means of bringing down the operational costs, leaving the human interaction for the high-value commercial transactions and financial advisory functions.

This might have come to an end, thanks to two main factors that are driving a substantial change in the way banks interact with their customers: Mobile and Social Media.

Mobile: A life of its own

The exponential growth of mobile applications have finally created a channel with a life of its own, where customers are approached and serviced in a new way. Where services exclusive to this channel are offered, and where banks are fiercely competing to differentiate themselves. Mobile applications and the power of Smart Phones are allowing banks to expand their relationship with customers, no longer constrained to the provisioning of financial services, but providing an emotional link between them and the customers lifestyle.

It is not just about allowing you to make a payment easily, or to buy or sell shares on the move. It is about providing an offering that is meaningful for you, in the place you are, in the mood you are or in the stage of your life you are in. More and more advanced services are proliferating around mobile applications which deviate from the traditional approach of using alternative channels as a cost cutter.

Wisely used, mobile applications can help the bank be seen an enabler in the customers lifestyle, which is just what it should be.

Social Media: The focus shifted

Social Media has probably not created the concept of digital life, but definitely has helped bring it to a level where virtually anyone has a very complete digital life, which is no more than a reflection of one’s real counterpart. Sharing your real life in your digital one has become a habit for hundreds of millions. The activity in these media is such that companies can simply not afford to be there, where their customers life happens. Where customers express their views and opinions about companies and their experiences with them, and where the early adopters are already starting to do some good business.

The focus is radically shifted towards the customer, which now has truly become king, now yes, this being completely true. Now customers decide what, where and when. Customers decide how and where they give you feedback, and how and where they want to interact with you.

Yet another channel with a life of its own.

As suggested by the title of this post, more to come on very interesting forms of channels like QR Codes and Microsoft Tags, and possibilities opened by new technologies like Siri.

NFC beyond payments

Posted by Iker Ibanez

The spread and adoption of NFC seems to be gaining momentum in the industry, with a number of terminals either supporting or having the intention to support the technology. With the exception of Apple, who still have to make a move in this space, most SmartPhone manufacturers are already shipping NFC-enabled devices, updated list can be checked here.

With strong support from key industry players like Visa or MasterCard, and with Google redefining the whole payments ecosystem, the late 2011 and early 2012 will see the consolidation of NFC as a standard feature in mid to high-end SmartPhones. Yet more to see if Apple decides to include the technology in their yet-to-be-seen iPhone 5.

While contactless payments will continue to be the source of growth for a number of years, however there are many other uses and applications that are strongly emerging, which promise a bright future for this technology. NFC is here to stay.

SmartPhones have been gradually conquering other devices space, replacing your agenda, phone, photo and video camera, business card holder… and even computer with very advanced applications being available out there in the respective appstores. The next thing to come is clearly your wallet, changing your old-fashioned plastic credit cards for their virtual counterparts.

Cash Cards have been successfully implemented in some markets, whilst others are still hesitant to make use of them. The burden of balance top-up is still something to be resolved. NFC can boost the usage of these, as they are really convenient for day to day micro payments where a contactless, signatureless payment can be really convenient. Vending machines, public transportation, paying a taxi or your coffee at Starbucks are likely to be done with a cash card, which now you will be able to store in your SmartPhone. And guess what, recharge it directly from your banking account too!.

But there is room for NFC beyond payments.

Merchants offering loyalty cards, with or without stored value can benefit of this technology. You have loyalty cards from a couple of airlines, half a dozen hotels, your favorite coffee shop and a myriad of other merchants. Now all of them can fit comfortably in your NFC-enabled phone, and you can easily track your points, miles and rewards easily in one single place.

Access control

Modern houses use cards and readers to access doors and gates instead of traditional keys, pretty much like you would see in any hotel. Wouldn’t it be nice to use your SmartPhone to access home?. And it would not stop here, home automation might be one of the next things to be conquered by your SmartPhone, so start guessing the possibilities here.

Anywhere requiring identification in the form of a card can benefit of NFC for access control, so will no longer have to carry your identification badge with you. Your phone does.

Information sharing

The next best thing is information sharing. In the era of Social Media, it is all about sharing. Also in the physical world, where you are likely to exchange your business card when you meet someone, give your phone number or your facebook profile to someone you just met, or leave your card to participate in the next lucky draw. All of them can now be done by putting your phone close enough, so you can transfer your contact details, social media profiles or leave a reduced version of your contact details on a merchant. How many times have you been asked to write down the same contact details on a hotel at check-in?. Guess what, never again.

And the last, yet best

It had to be Rovio and in had to be Angry Birds to give us the latest example of NFC. The latest version of their ultra-popular game, still only available on the new NFC-enabled Nokia C7,

allows gamers to contact other gamers to unlock new levels of the addictive game. Fun?.

Posted in Android, App Stores, Apple, Application, Devices, NFC, Payments, Smartphones, Social Media, Technology

Tags: Access Control, Angry Birds, Apple, Applications, AppStore, Contactless, Device, Facebook, Gaming, Google, Interaction, iPhone, NFC, Payments, Phone, SmartPhone

This is not an app review

Posted by Iker Ibanez

This is not an app review. It is rather some thoughts and reflections on how much technology and features are packed in any of the SmartPhones you can buy today. We have taken it for granted, but it is truly amazing to see that you can carry in your pocket a device that contains a GPS, a compass, a high definition photo and video camera, plays music, browses the internet and is capable of doing all at the same time through powerful multitasking. But does anyone need so many features?. I thought not.

But then I started running. I am not a big fan of it, so I just started to reduce a bit of extra weight gained during the holidays. However, I found an application that motivated me to start, and to continue doing it on a regular basis. It is called Runmeter. Probably there are a lot of applications similar to this one, but this is the one I chose, and with which I truly realized how wonderful applications and features you can build when you make use of all the powerful technology Smart Phones pack today.

GPS

You define a route, press the start button and there you go. It tracks your run by GPS pretty accurately. Not only it tracks where you go, but also how fast you go, so you get instant pace, average pace, pace per km, even altitude deviations, although these are not really accurate. The GPS bit in action. Good?. Wait and see…

Internet

Do you need Internet connection while running?. Not for web browsing, definitely, but one fantastic feature of this application is that it integrates with facebook and other social networks, so you can choose what the app publishes for you when you start, stop and finish running. Social Media is all about sharing and interacting, so now you can share your progress while you train. Nothing revolutionary here, but this becomes really fancy when you go to the next step, and you not only share but you also interact. How can you interact while you are running?. Easy, the application will monitor any comments your friends might do on your “Started run” post on facebook and guess what? It will read them out loud to you on your headset. This is my favorite feature, it is really motivating, and when your friends know that they are being read out loud while you run, they really become imaginative and encouraging. Really good.

And music!

What is running without music?. All of the above while you keep your pace listening to your music. Either with the standard iPod included in your iPhone or with my favorite Spotify, that allows you to find those disco hits from the early 90’s you used to dance to and remember the time while on the run. Superb.

Probably none of these are truly revolutionary aspects from a technology perspective, not even from the fact of being packed into a tiny little device. It is the combination of all of them working in harmony that makes really good applications possible.

Sensorconomy

We started by integrating data into applications, now we are integrating sensors like GPS or compass. Some analysts predict Sensorconomy would be the next big thing in Smart Phones by introducing temperature, humidity,light and other sensors into Smart Phones to extend the boundaries of your device and allow it to interact more. I really think the hardware is going further ahead than the applications in the mobile space, which is really thrilling. We have just started to take off in making use of the current possibilities so the future of mobile applications looks promising, at the very least.

Posted in Application, Devices, Innovation, iOS, Sensorconomy, Smartphones, Social Media, Sophistication, Technology

Tags: Applications, Device, Facebook, GPS, Innovation, Integration, Runmeter, Sensor, Sensorconomy, SmartPhone, Social Media, Social network, Spotify

Social Media and Customer Relations

Posted by Iker Ibanez

This wonderful article made me think about how some industries are making use of Social Media whilst other are still very hesitant about it. It also does a very interesting insight on how the relationship between these companies and their customers are changing, and even more interesting, how the perception the customers get are also changing accordingly.

Air travel is being one of the industries which most benefit is getting from Social Media. Nearly 200 airlines are already actively present in Social Media, and the nature of this industry is clearly benefiting from having a direct and real time communication channel with their customers. Air travel operations are subject to innumerable and unpredictable situations that cause disruptions and delays. So from a purely operational point of view, it is clear that Social Media, specially facebook and twitter are key elements in this new way of addressing customer communications. Delays and cancellations for any of the classical reasons -weather, plane maintenance, crew rotation, etc.- can now be made known to the wide audience.

Not that this will solve any of the issues and eliminate the delays or cancellations, but it is definitely helping customers be aware of the situation and plan accordingly. Knowing is better than not definitely.

This is probably the most obvious usage of Social Media, but probably not the most powerful. Three different usages can be identified:

- Communication with customers (operational)

- Feedback

- Marketing and sales

The power of feedback

Think about feedback. This is a double edged weapon. Feedback is good, and making things easier for customers to give feedback right where and when the issue or the good experience is happening clearly encourages more than filling a feedback form. People just tweet their last good or bad experience, or post a comment on your wall about it. This is really powerful, but demands a managed presence in Social Media to be able to listen to this feedback effectively.

But this has a downside too, which I tend to see as a big opportunity. You can no longer hide failure. If you cause a problem to a customer, not only you will know, your whole set of followers will do. This obviously can be seen as a downside, but I clearly see this as an opportunity for companies to improve customer service and attention, and really treat customers as they deserve. Furthermore, most of the failures in customer service will remain undetected behind the fact that customers rarely complained, and even more, complains never reached the media. Now this has completely changed, but also for good, now you know where your weakest points are, so your customers become your best allies.

The true revolution

The more I look at Social Media adoption in the large Enterprise, the more I see it as a movement towards customer centricity. No longer we make the customer come to our online systems, we go to where the customer spends his or her time

online. We do not ask for feedback or claims to be given in a particular manner and a particular place, we listen to the customer wherever and whenever the customer is.

This is for me the authentic revolution of Social Media in the Enterprise. Not only being able to communicate, but reinventing all our customer interactions to be where and when the customer is, on every occasion where the customer needs to interact with us. For good and for bad.

For me, this is why Social Media is already revolutionary. Now I am really keen to see how other industries adopt are able to open themselves to this new world of possibilities. Challenging but really thrilling and full of potential.